If you are looking for access to easy and instant funds, then instead of asking from your friend or relative, it is always better to opt for instant cash loans. The application process, if initiated from the right application, is usually simple and straightforward.

Undoubtedly, the accessibility that financial applications offer has led to a healthier country in monetary terms. Gone are the days when people used to travel to banks to gain access to loans.

What is a fast cash loan?

As the name implies, it is a short-term loan that offers potential borrowers instant access to a small amount of cash in order to cover emergency expenses or unexpected financial obligations. This loan type is generally offered by alternative lenders or credit unions and can be easily obtained with little to no credit check or even collateral requirement.

These loans are usually used to cover unexpected expenses such as medical bills, vehicle repairs or other urgent expenses. The amount of the loan is generally small, and its repayment period is short, usually two weeks to a month.

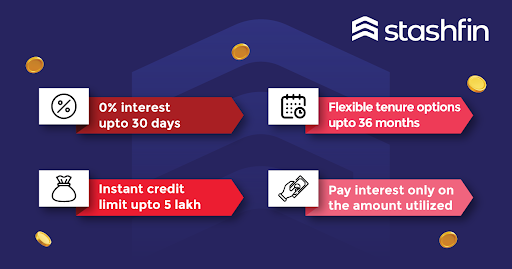

What are the features and benefits of fast cash loans online?

Instant cash

One of the top pros of such loans is that it offers quick and convenient access to cash when they need it the most. In addition, the loan application process here is relatively easy and fast, and the funds can be transferred to the potential borrower’s bank account on the same day.

Helps build credit

Some lenders may report fast online cash loan payments to the credit bureaus, which helps the borrower build or improve their credit score over time. This can be especially beneficial for those with poor credit scores and planning to improve them.

Repayment Flexibility

It gives the borrower flexibility, allowing them to repay the amount over a more extended period. However, these loans usually have a short repayment period, ranging from two weeks to a month.

No collateral

Such loans are usually unsecured, which means that the borrower doesn’t need to provide any collateral to secure the loan. This is quite beneficial for those who do not have assets to pledge as collateral.

No Credit Check Required

These types of loans do not require a credit check, which basically means that borrowers with poor credit scores or no credit history can still qualify for a loan. This makes such loans an accessible option for those who have been turned down by traditional lenders.

How to avail instant cash loans?

Stashfin offers the feasibility to all potential borrowers to avail the loan facility from its website or simply by downloading their application from the Play Store/App Store as per their device. However, if you are planning to download the application, here is the step-by-step guide:

- Download the Stashfin app from the Play Store/App Store

- Sign up using your mobile number

- Add your details to check your credit limit

- Complete KYC and you are good to go!