What is a Personal Loan?

A personal loan is a sum of money that is borrowed for a variety of personal expenses – e.g., Marriage loans, medical loans, vacation loans, etc. It can be classified into secured and unsecured loans. Secured loans mean that the borrower would need to offer collateral in exchange for the sum of money borrowed. This means that in the event where the borrower is unable to repay the loan, the collateral they had offered would be seized by the bank or lending body. Unsecured loans, on the other hand, require no collateral.

What is a Credit Score?

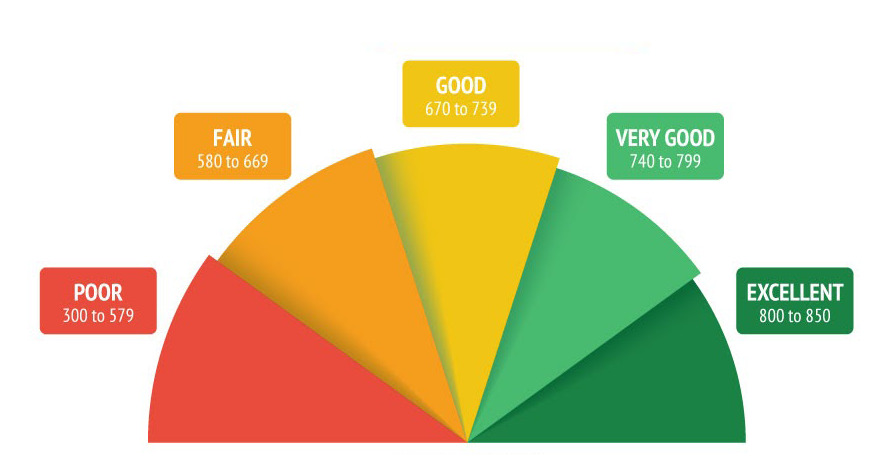

In short, a credit score is a numerical indication of a customer’s creditworthiness. This score ranges between 300 and 850. The higher the credit score of a potential borrower, the stronger a candidate’s position to repay the loan. In other words, one’s credit scores help to evaluate the probability that s/he will repay their loans in a timely manner.

The illustration below indicates the ratings associated with each credit score.

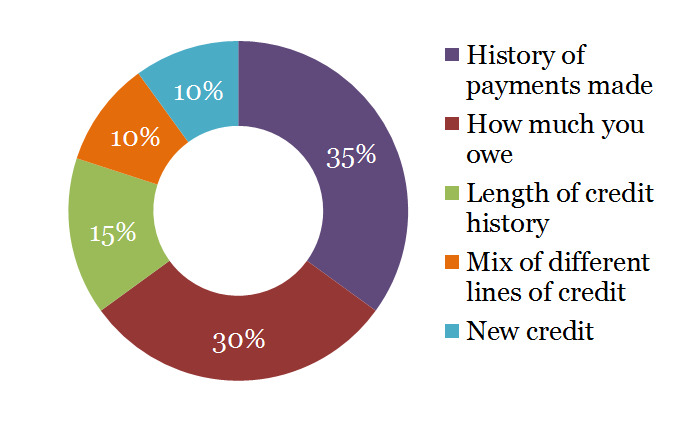

Personal Loans and how it affects your Credit Score. One’s payment history (that constitutes 35%) reflects on whether an individual pays their dues punctually. One’s outstanding debt (30%) accounts for the percentage of credit that is being utilized. Length of credit history (15%), as the name suggests, refers to the duration that an individual has held a debt. The shorter the credit history, the more advantageous his overall credit score. Credit mix (10%) shows if an individual holds more than one installment credit – e.g., car and mortgage loans. The last 10%, new debt, considers the number of new account inquiries an individual has applied for in the recent past.

Your personal loans can help raise your overall credit score, but on the condition that they are repaid punctually. While you are in the process of repayment, or in other words when your personal loan is yet to be repaid, your credit score can be reduced by a significant amount. This will be a temporary hit, as your credit score will be increased once you pay off your personal loans on time.

There is a fair chance that while your loan is still unpaid, you may not be eligible to take up further loans. For example, if you apply for a house loan and shortly after for a car loan, there is a possibility that the credit agency will reject your second application as they believe that you have as much debt as you can handle. However, your credit score does not just depend on a single loan.

If you have established a strong history of managing your dues and repaying them punctually, the impact on your credit score for a new loan will likely be lessened. If you show that you have paid off your personal loan in a timely manner, it showcases your responsibility to handle debt, and this will in turn boost your credit score.