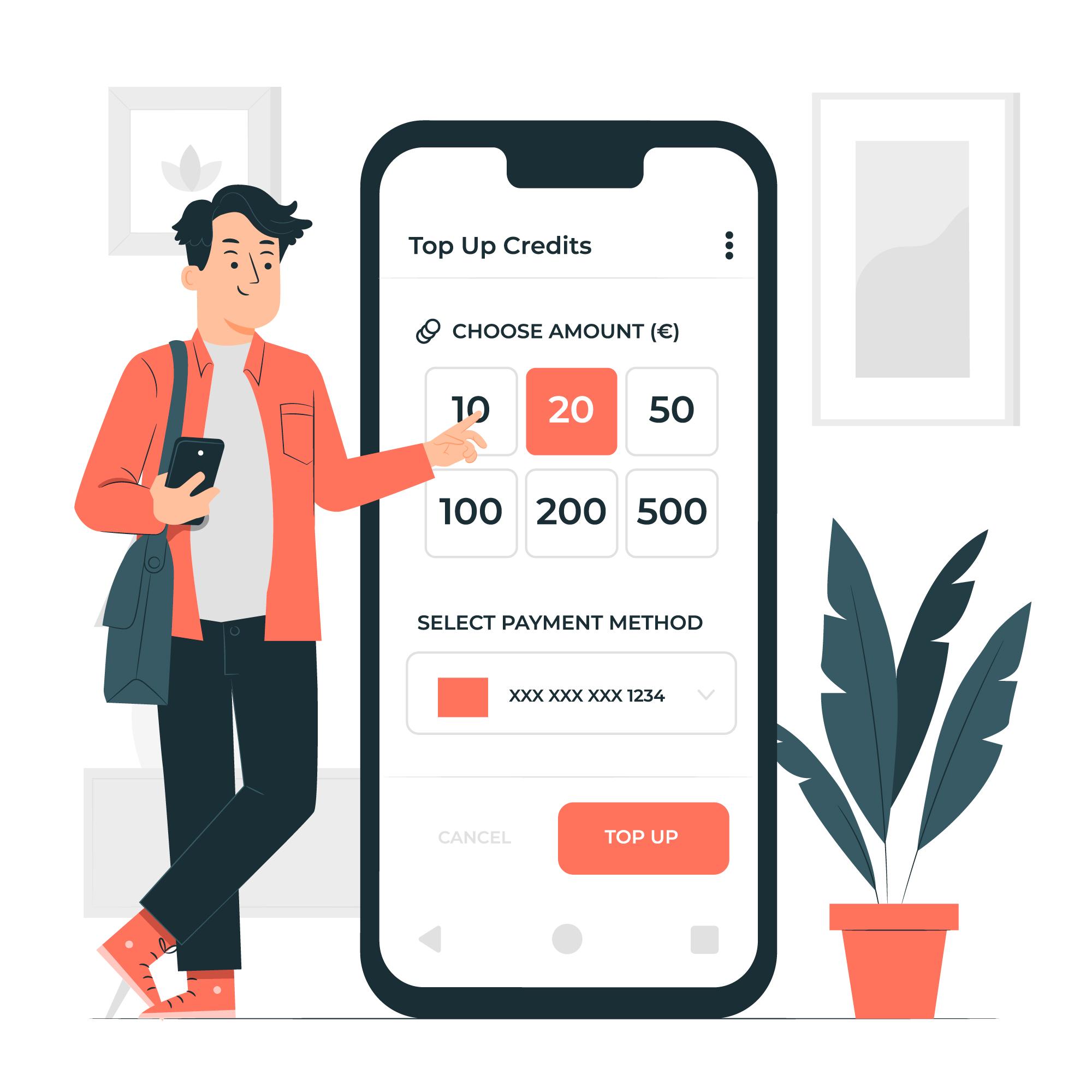

When we imagine getting an instant personal loan, we might picture people standing in line, waiting for many extra steps, and feeling frustrated. But thanks to technology, things have changed a lot in the world of lending. You don’t have to go anywhere today to get a personal line of credit. All you need is your smartphone with the internet.

Especially in urgent situations, this type of loan can be really helpful for meeting your needs. There are moments when people need money quickly and without any complications. That’s where a personal loan comes in handy!

What are the 9 benefits of choosing an online loan app?

1. Paperless Documentation

When you opt for an online loan app, you can skip the trips to banks or offices. Instead, you can upload the required documents on the app or website.

2. Simple Application

Well-known banks, institutions, and companies offer quick loans with an easy and efficient application process. Stashfin, for example, provides instant personal loans through a straightforward process. Just download the app or visit their website, sign up, upload documents, and wait for approval.

3. Speedy Approval

Traditional loan applications used to take days or even weeks for approval. But with online loan apps, the average approval time is now measured in minutes. Stashfin’s instant loan app can get your loan approved within hours.

4. Flexible Amount and Tenure

Instant personal loans offer flexibility in choosing both the loan amount and the repayment duration.

5. 24/7 Accessibility

An Online loan app is available round the clock. Just download it and apply for a loan whenever you are in need of financial help.

6. Convenience

No more waiting in banks for hours. With user-friendly online loan apps, you can easily apply for an instant personal loan from your comfort zone. Download the app and apply. It’s quick and hassle-free.

7. Versatile Use

Online loan apps allow you to use the money for various purposes, whether personal or business-related. You don’t need to explain the reason for the loan.

8. Direct Bank Transfer

Online loan apps often provide a direct transfer option, ensuring you get the approved loan amount without delays.

9. Small Loans

These apps offer small personal loans, making it convenient for your needs. So, next time you need a small loan, consider using an online loan app for its benefits.

How to Get a Loan Online from StashFin?

Follow these steps for a hassle-free small loan from StashFin a personal loan app:

- Download this app from the Play Store/App Store

- Sign up using your mobile number

- Add your personal details to check your credit limit

- Complete KYC and you are good to go for an instant personal loan online!

The realm of financial emergencies is characterised by unpredictability. With StashFin at your side, these concerns can become a thing of the past. Embark on your journey to financial stability by applying for small loans through StashFin today.

Conclusion

The lengthy and exhausting process of obtaining conventional personal loans. Having grasped the benefits of utilising an online loan app, take the next step by downloading the Stashfin Personal Loan App. This will grant you access to a diverse range of loan options, including personal loans, vehicle loans, consumer loans, and more.